Were you taught how to save money?

I wasn’t. I was told to save, but wasn’t shown how. It was never really modeled well, and school instruction surrounding budget was more theoretical than practical. So it was no surprise that when I became an adult my savings account never grew past $100 or so. Similar to the generation(s) before me, I could pay my bills, cover my needs, and a few small wants were within reach, but I just never could quite figure out how to grow a savings account long term.

The patterns repeated themselves until three things collided: I got tired of repeating the cycle, started sticking to a budget, and discovered an app that helped me with small, achievable goals. This isn’t a sponsored post, I get nothing in return unless you want to use the referral link for the app at the end (but you don’t have to!). I’ve heard from so many people in my life that I should share “my ways”, so this is another one of those life hack things that has changed me for the better! With the start of a new year and so many people looking for ways to improve their lives/lifestyles, I figure the timing is right to share my budgeting/saving secrets. So here’s a brief overview:

Are you tired of it?

I’m 100% serious. You have to be ready to make a change. Or probably, a LOT of changes. You have to be so sick of repeating the same mistakes, of living the same life. It requires sacrifice and discipline; neither of which are “fun”. I think of the definition of ‘crazy’ someone shared with me years ago: “Doing the same thing over and over again, but expecting different results.”

First, you have to acknowledge that what you are doing or what you have tried is NOT working. I had made almost no gains to my life savings from when I was 16 to 26. Ouch.

Louder for the people in the back:

NOTHING CHANGES IF NOTHING CHANGES.

Are you tired of it? Let’s begin…

The Budget:

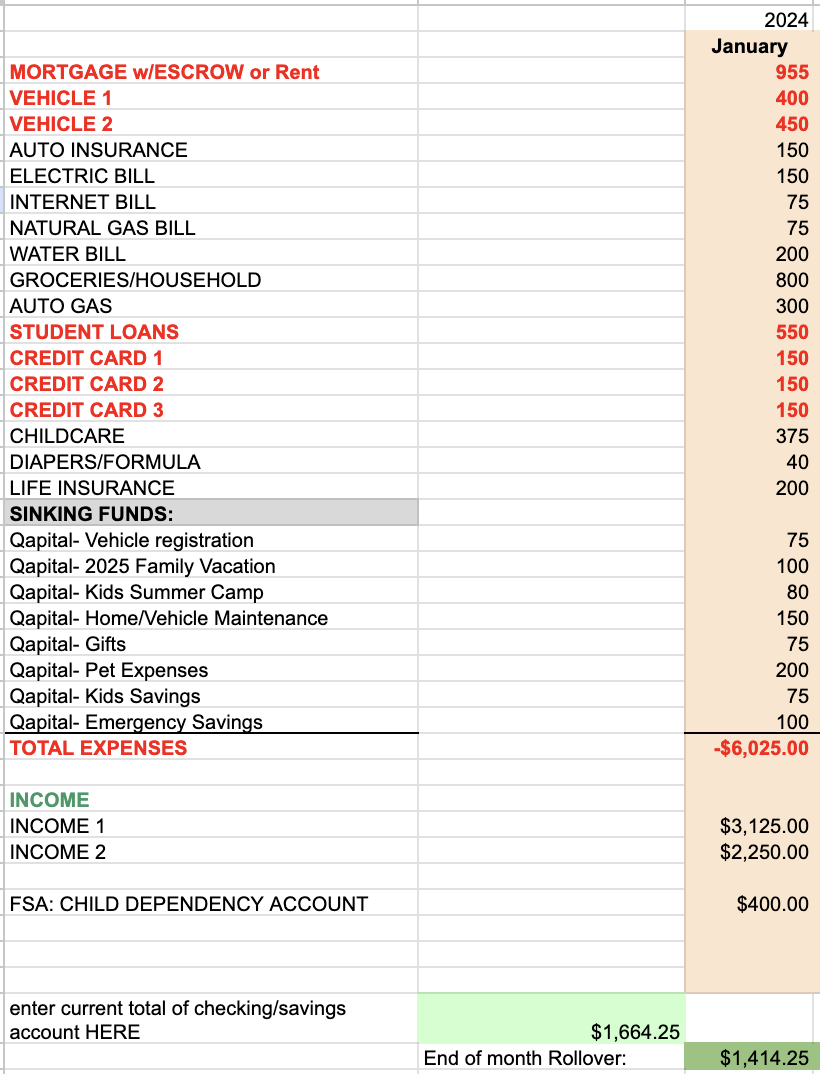

I started with (you guessed it), a spreadsheet. On the left hand side, I listed every single monthly expense, and put each month across the top. Not sure what you’re spending? For things like monthly gas, groceries, etc. check out your most recent 3-6 months of bank statements and average your spending. It’s ok if you don’t get it exact right away, you can adjust as you go!

At the very bottom, total your expenses, then enter in your monthly household income(s).

Now ask yourself: Is my/our monthly income MORE than our monthly spending/expenses?

So often when talking with friends, the answer is: no. So here comes some tough love- you need to do 1 or 2 things: CUT spending habits or expenses, and/or bring in more income.

Here’s what your spreadsheet might look like starting out:

(and don’t bite my head off, I threw some random numbers in to make it work, but obviously this isn’t 100% accurate):

I’m a visual person so I color code my expenses in red as debt, and black as monthly recurring expenses.

We’ll talk about sinking funds later when I introduce you to the app.

Once you think you’ve got it allllll written out, take a hard look at your spending habits, then make cuts. TV service- gone. Monthly subscription services- gone. Coffee habits, hair/nail services? Gone. Strip down your bank statements and look at every single transaction and figure out where your money is going. It’s tedious, but it’s important.

Once I was able to really see, analyze and eliminate all of the “extra” spending, I was able to determine exactly how much I truly wanted to put away, and then how much I had “leftover” for other things like that caramel macchiato, new shirt or shoes, hair appointment, home decor item, or tech gadget.

The main reason I couldn’t save? Because I wasn’t putting money into savings.

I was spending it.

[Duh]

No really- it was that simple. I never was taught the discipline of putting money into savings FIRST, then deciding what and how to use the rest if there was any.

Developing a budget takes time. It takes trial and error. Give yourself some grace to just start somewhere, and then adjust as you go month by month. Currently, I update my spreadsheet weekly, but starting out- you may find it helpful to challenge yourself to keep a record of daily spending. Where is every penny going? Write it down on paper, or in your notes app on your phone. Add a note to your calendar, then review weekly until you get a better handle of it.

One part of the budget I won’t go into detail in this specific post, but can elaborate on at a later date: making a plan to pay off bad debt(s). This takes some time to fine-tune, and everyone has a different method or idea of what bad debt looks like. For now, just know that ours was a LOT. When you start actually pulling those statements, looking at the interest, calculating how long it takes to pay it off and see where your money is going, you first get sick to your stomach, then feel hopeless, but soon enough you’re motivated to make a positive change.

A few calculators I love that helped me with our budget:

^^This one is a favorite of mine!

Now… what is this miracle app I speak of?

The app: Qapital

When you’re establishing your budget and goals, but have yet to learn discipline, you need something that’s automatic and easy.

Let me introduce you to an app called Qapital:

I’ve used it since 2016 that’s how great it is. At the time I started saving it was a free app, but it now does have a small cost of $3 a month. Is it worth $36 a year? If you have zero discipline and need some help- 10000% yes. Yes, yes, and yes. Here’s how it works:

1. You connect your bank account of choice to the app.

2. Create a “Goal”- I started out just creating a savings goal of $500.

3. Set a rule: I chose initially to use the “round up” rule- wherever I swiped my debit card, it would round up to the nearest dollar and put that change difference into the savings account. So, if my total was $19.64, it put .36 cents into my savings account.

4. Wait and watch yourself save.

I wouldn’t notice .36 cents “missing” from my account anyway, right? It’s sort of like how our parents or grandparents had a “change jar”.

Before I knew it, I hit my $500 goal and I had barely noticed the “change” missing from my account. So I added a second goal. This time, I created a weekly rule- putting $5 per week aside over a year’s time to pay for summer camp. Then a 3rd goal- our annual “Vehicle Registration fees”, but spread out over 52 weeks worth of weekly saving. Then a 4th- a “Gifts fund” to pay for all the birthday, Christmas, and random gifts throughout the year. Then a 5th- Pet/Vet Clinic fund, 6th- Vehicle/Auto Expenses, 7th- Summer Fun like pool passes, theme park tickets, state fair admission, etc, then an 8th- family vacation, 9th- couples vacation, 10,11,12,13th- kids savings accounts, 14th- Emergency savings accounts, 15th-Extra student loan principal payment per year or per quarter…. and so on. I went from putting away NOTHING, to setting aside pennies, to $5 weekly, to putting more than 30% of our income into savings, and/or sinking funds. I now have more than 15 goals that I transfer $$ into regularly.

So what happens when you need the money? You just transfer it back to whatever account you want and it’s there the next day (or same day if you want for a small fee).

But what if it goes to pull money from my account and it overdraws me? It won’t- if the funds aren’t available in your “pull from” account, the app stops the transfer of funds to your goal and notifies you without overdrawing. So you don’t have to worry about overdraft fees.

Qapital completely changed the way I budget and save.

If you would’ve told me 7+ years ago that I could set aside more than 30% of our income for savings, I would’ve said you were bat $#!& crazy.

Listen, are there ‘better’, more strategic ways to save my money and earn interest, blah blah blah…? Yea, I’m sure there are. We’ve since utilized some of these other avenues, but when we were getting started and for the convenience- this was and still is an AMAZING strategy used by our family. The best way to save is however works for YOU.

If you think Qapital is worth trying, I do have a referral link that earns you $25, and it also sends me a $25 referral fee (After you make 1 deposit towards 1 goal, and keep your account open for 45 days.) So at $3 a month, this referral link pays you back for the first 8 months of use. Click here for the link if you’d like.

Girl math- it’s FREE then, right?!

Or you can absolutely forgo the referral link and just download the app on your own too- no hard feelings. This is one of my best life HACKS I swear by!

Now, you’re nowhere near done.

Once you get the hang of the budget, you’ve created and are hitting your savings goals, adjusting/adding sinking funds, you then get to take your spreadsheet from a few months out to a whole year, then 2 years, 3, 5, 10 years, etc.

Don’t laugh- but I have an estimated budget planned out for 10 years. Yep. Ten years. How else am I to plan for things like my kids first vehicles? College? Retirement?

Sometime I’ll elaborate on how I formed our budget, determined sinking funds, and found ways to cut back on expenses, but for now, you get to working on those spreadsheets, and I’ll chime in down the road with a few more words of wisdom.

Here’s to wishing you some financial freedom in this new year! Happy budgeting ;)